How to Open or Create a PayPal Account (Nigeria) – Full Guide

Opening a PayPal account in Nigeria has become a necessity for many individuals and businesses, especially those involved in online transactions. With the ever-growing popularity of e-commerce and online freelancing, having a PayPal account makes it easier to send and receive payments globally. This comprehensive guide outlines the steps on how to open a PayPal account in Nigeria, and provides useful tips on managing your account, funding, and withdrawing money.

What is PayPal?

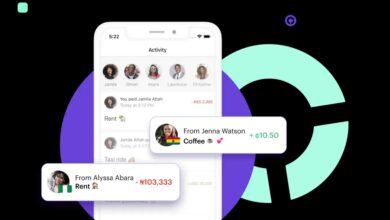

PayPal is a leading online payment platform that allows users to send, receive, and transfer money across the globe. It is widely used by millions of individuals and businesses for various online transactions, including e-commerce purchases, freelance payments, and personal money transfers. PayPal offers a secure and convenient way of managing online payments, making it the preferred choice for many.

Why Open a PayPal Account in Nigeria?

There are several reasons why opening a PayPal account in Nigeria is beneficial:

- Global transactions: PayPal enables you to send and receive payments from abroad easily and securely, making it an ideal choice for those involved in international transactions.

- E-commerce and online freelancing: Many online marketplaces and freelance platforms prefer PayPal as their primary mode of payment. Having a PayPal account increases your chances of getting hired and paid on these platforms.

- Security: PayPal offers a high level of security for online transactions, ensuring that your financial information is protected.

- Convenience: With a PayPal account, you can manage your online payments with just a few clicks, making it a convenient choice for online transactions.

How to Open a PayPal Account in Nigeria

Opening a PayPal account in Nigeria is a simple and straightforward process. Follow these steps to create your account:

Step 1: Visit the PayPal Website

Visit the official PayPal website and click on the “Sign Up” button at the top right corner of the page.

Step 2: Choose a Business Account

Select the “Business Account” option as it allows you to receive payments from abroad and manage your online transactions more effectively. Personal accounts have limitations on receiving funds in Nigeria, so it’s best to choose a business account.

Step 3: Enter Your Personal and Business Details

Fill out the registration form with your personal and business information. Make sure to provide accurate details, as this will be crucial for verifying your account later. Some important points to consider include:

- Use your legal full name as it appears on your government-issued ID.

- Provide a valid email address that you have not previously used to register a PayPal account.

- Enter your Nigerian phone number by selecting the Nigerian flag and entering your number.

- Use your residential address if you do not have a business address.

- Choose the primary currency for your account, preferably US Dollars.

Step 4: Confirm Your Email Address

After submitting the registration form, PayPal will send a confirmation email to the address you provided. Click on the verification link in the email to confirm your account.

Step 5: Log in and Complete Your Account Setup

Log in to your newly created PayPal account and complete the additional steps on your account dashboard, such as verifying your email address and providing more information about your business.

Step 6: Link a Bank Account or Credit/Debit Card

To start using your PayPal account for transactions, you need to link it to a Nigerian bank account or a credit/debit card. Follow these steps to link your account:

- Log into your PayPal business account via the PayPal website or mobile app.

- Click on “Wallet” in the menu bar, then tap “Link bank account” or “Link a credit or debit card.”

- Enter the required bank or card information and click on “Link card” or “Link bank account” accordingly.

Now, your PayPal account is set up and ready to use for online transactions.

How to Fund Your PayPal Account in Nigeria

There are multiple ways to fund your PayPal account in Nigeria:

- Transfer from friends: You can ask friends with PayPal accounts to send you funds in exchange for the Naira equivalent. Ensure that you trust the person to avoid being scammed.

- Fund from a debit card: Linking your Nigerian debit card to your PayPal account allows you to load funds directly from your bank. Make sure you have sufficient funds on the card before initiating the transfer.

- Buy from online exchanges: Some online exchanges offer PayPal funds at varying rates. Carry out thorough research and read reviews about the platform before making a transaction.

How to Withdraw Money from Your PayPal Account in Nigeria

To withdraw money from your PayPal account in Nigeria, you will need a UBA AfriCard or a similar card that supports international transactions. Follow these steps to withdraw your funds:

- Log in to your PayPal account and click on “Withdraw Funds” on the dashboard.

- Select your PayPal balance as the source of funds and choose your linked Visa card as the destination.

- Enter the amount you wish to withdraw and click on “Continue.”

- Review the transaction details and click on “Transfer” to initiate the withdrawal process.

Please note that it may take a few business days for the funds to reflect on your card, although the transfer is usually instant.

Tips for Managing Your PayPal Account in Nigeria

To ensure a smooth experience with your PayPal account in Nigeria, consider the following tips:

- Security: Always use a strong, unique password for your account and avoid sharing your login details with anyone.

- Legality: Provide accurate and legal information when registering for your PayPal account. This will be crucial in case you need to verify your identity or recover your account.

- Withdrawal charges: Be mindful of the $5 withdrawal fee charged by PayPal. To minimize costs, consider withdrawing larger amounts less frequently.

- Withdrawal timing: To maintain a legitimate appearance, avoid withdrawing funds immediately after receiving them. Wait at least a day before initiating a withdrawal.

By following these tips and guidelines, you can successfully open and manage a PayPal account in Nigeria, making it easier to conduct online transactions and grow your online business or freelancing career.